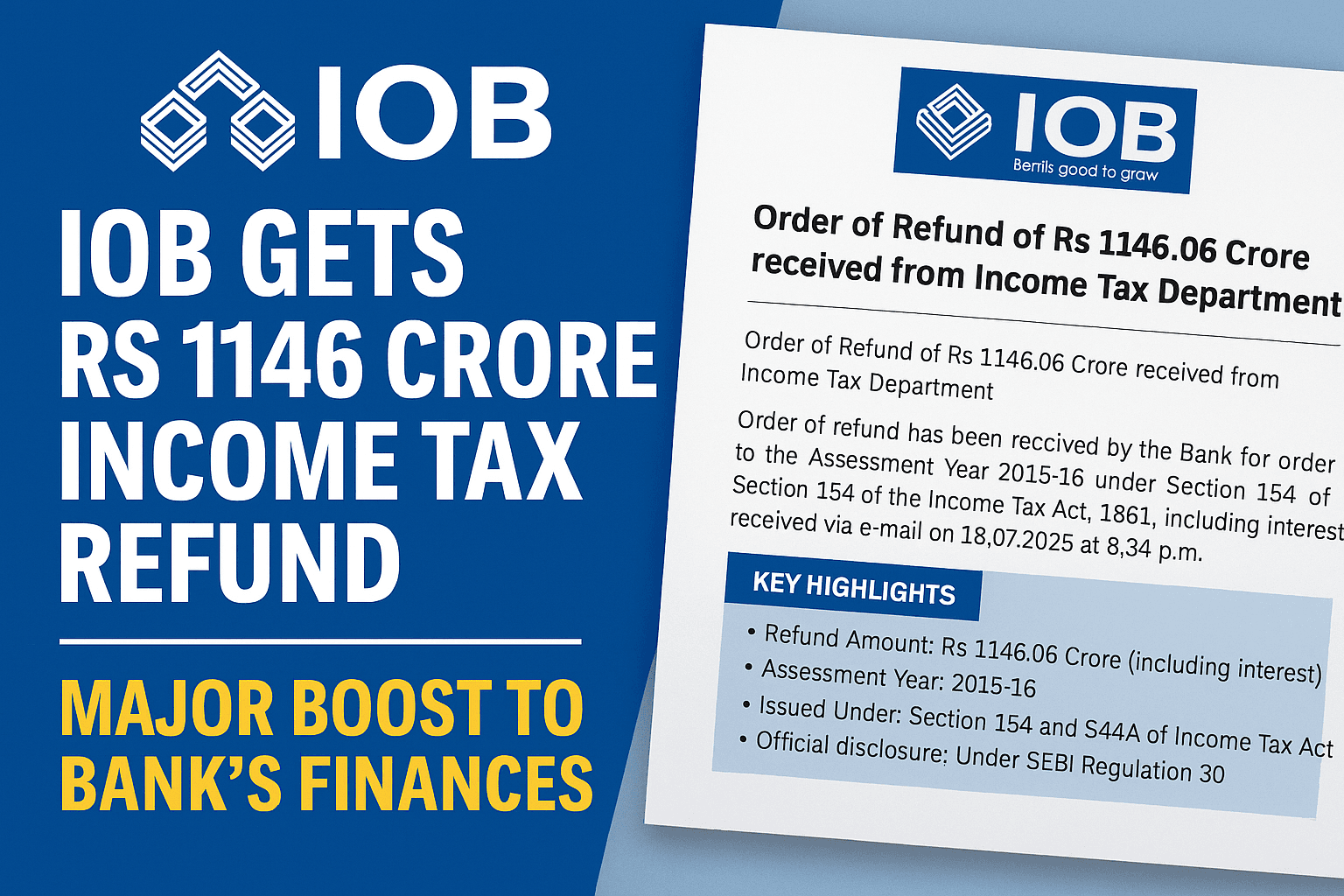

IOB Gets Rs 1146 Crore Income Tax Refund – Major Boost to Bank Finances

Psu express

Indian Overseas Bank IOB has received a significant income tax refund of Rs 1146.07 crore for the assessment year 2015-16. The refund was issued under Section 154 of the Income Tax Act 1961 and includes interest under Section 244A. The order was received by the bank through email on 18 July 2025 at 8.34 PM.

As per the official exchange filing dated 19 July 2025, the refund strengthens IOBs financials and is expected to support its capital adequacy, profitability, and future operations. This marks another positive development for public sector banks as they continue to improve their balance sheets and comply with SEBI disclosure regulations.

Key Highlights

-

Refund Amount: Rs 1146.06 Crore including interest

-

Assessment Year: 2015-16

-

Issued Under: Section 154 and 244A of Income Tax Act

-

Official Disclosure: Under SEBI Regulation 30